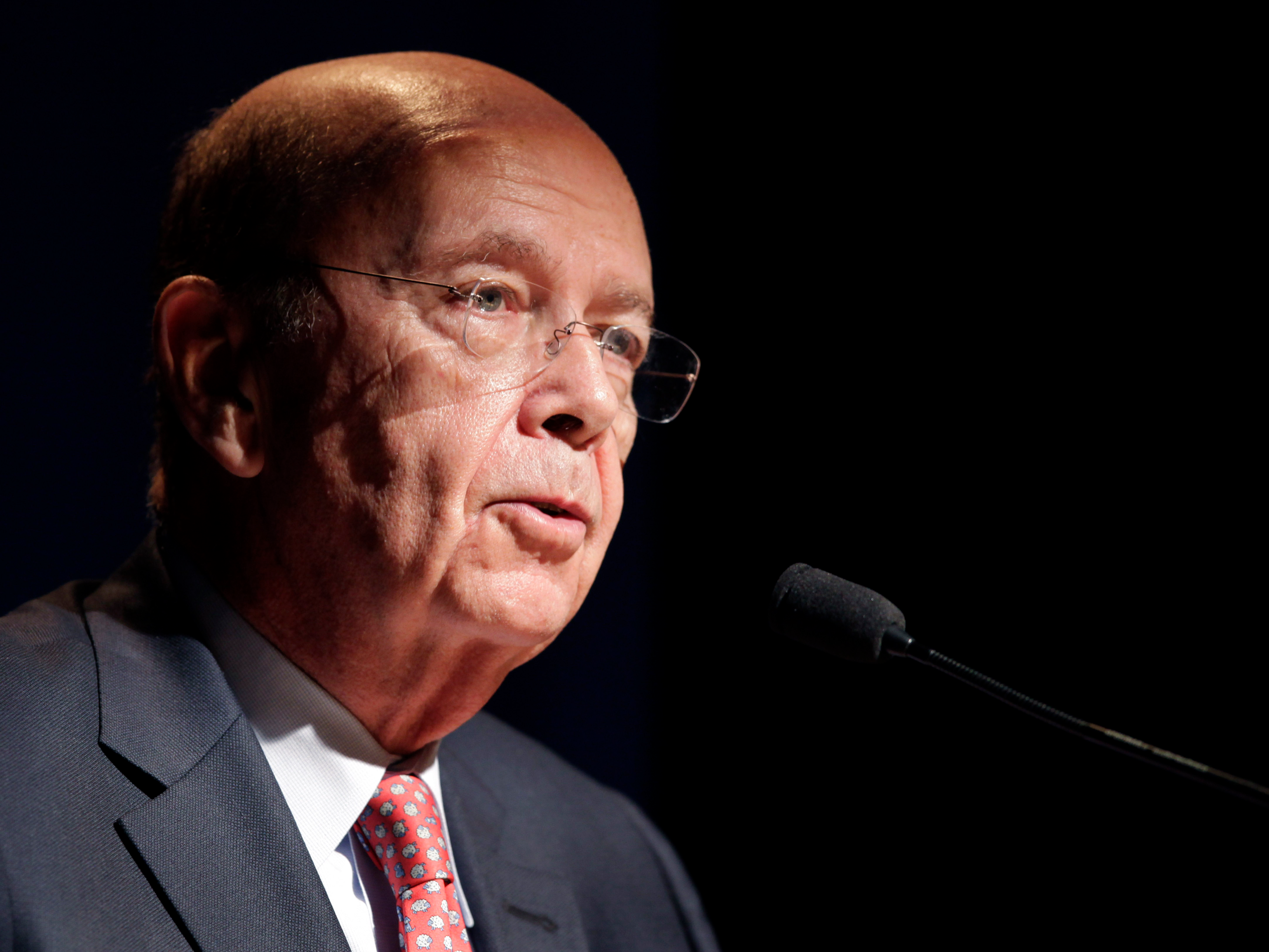

In a Wednesday-morning interview, Commerce Secretary Wilbur Ross told Bloomberg the US had been “in a trade war for decades.”

“We’re in a trade war,” he told Bloomberg in the televised interview. “We’ve been in a trade war for decades. That’s why we have the deficit.”

He added that his team was open-minded about the North American Free Trade Agreement discussions.

The Mexican peso extended its early losses slightly after Ross’ comments. It was down by 0.7% at 19.6444 per dollar as of 8:01 a.m. ET.

Last week, Ross argued in an interview with CNBC that the peso would recover should the US and Mexico manage to renegotiate and improve a trade deal.

"The peso has fallen a lot mainly because of the fear of what will happen with NAFTA," he told CNBC on Friday. "I believe that if we and the Mexicans make a very sensible trade agreement, the Mexican peso will recover quite a lot."

"I think partly the decline in the peso was due to worry about renegotiation of NAFTA, but I think we also need to think about some other mechanisms for making the peso/dollar exchange rate a bit more stable," he added.

His comments last week appeared to have a more conciliatory tone, but it's worth noting that a weaker peso relative to the dollar comes with negative side effects for US companies that have heavy exposure to Mexico.

Effectively, when the greenback strengthens against the peso (or the peso weakens against the dollar), then goods and services in the US become more expensive for Mexicans. Therefore, they may buy less of those American-made goods and services going forward, which is bad for American producers.

"A more stable (and stronger) peso is of course in the interests of the Trump administration, as the more the currency weakens the cheaper Mexico's exports become," Neil Shearing, the chief emerging-markets economist at Capital Economics, wrote in commentary on Friday after the CNBC interview.

The peso saw a tumultuous autumn and ended up being one of the big market casualties of the 2016 election. It crashed by about 20% after President Donald Trump won the election.

But it has recovered since Trump's inauguration. In mid-February, after US Secretary of State Rex Tillerson met with Mexican officials, it pushed to its strongest level against the greenback since the day after Trump's election.

Back during his confirmation hearing, Ross said NAFTA would be an early priority for his department. He said he was "pro-trade" - but only as long as it were "sensible trade."